Custom scoring rubrics for consistent deal analysis

Stop relying on gut feel: build systematic deal evaluation

Nov 20, 2025

The Problem: Spending Hours Reading CIMs That Don't Fit Your Criteria

You're evaluating 100 deals per month—some of you even more. Partner A loves high-growth companies even if margins are thin. Partner B only cares about capital-light business models. You're working across deals, across industries, and your evaluation criteria are constantly evolving and being refined.

So every deal gets evaluated differently. But there's a bigger problem: you're spending 2 hours reading a 60-page CIM to make sure you haven't missed something critical, only to realize on page 47 that customer concentration is way too high for your thesis.

This is time wasted that you'll never get back.

Meanwhile, ChatGPT users are trying to solve this with custom prompts, but they're getting inconsistent results and losing everything when they close the chat. There's no structured way to capture, review, and store the analysis.

This is how great deals get missed and mediocre deals consume your time—because there's no systematic way to screen opportunities against your actual investment criteria.

DealSage solves this with custom scoring rubrics that help you focus earlier on the best opportunities, filter out poor fits in the first 48 hours, and maintain consistency across your entire pipeline—even as your criteria evolve.

How Custom Scoring Rubrics Work

Custom Scoring Rubrics let you define your investment criteria once, then apply them consistently to every deal—screening 60-page CIMs in minutes instead of spending 2 hours hoping you didn't miss something critical.

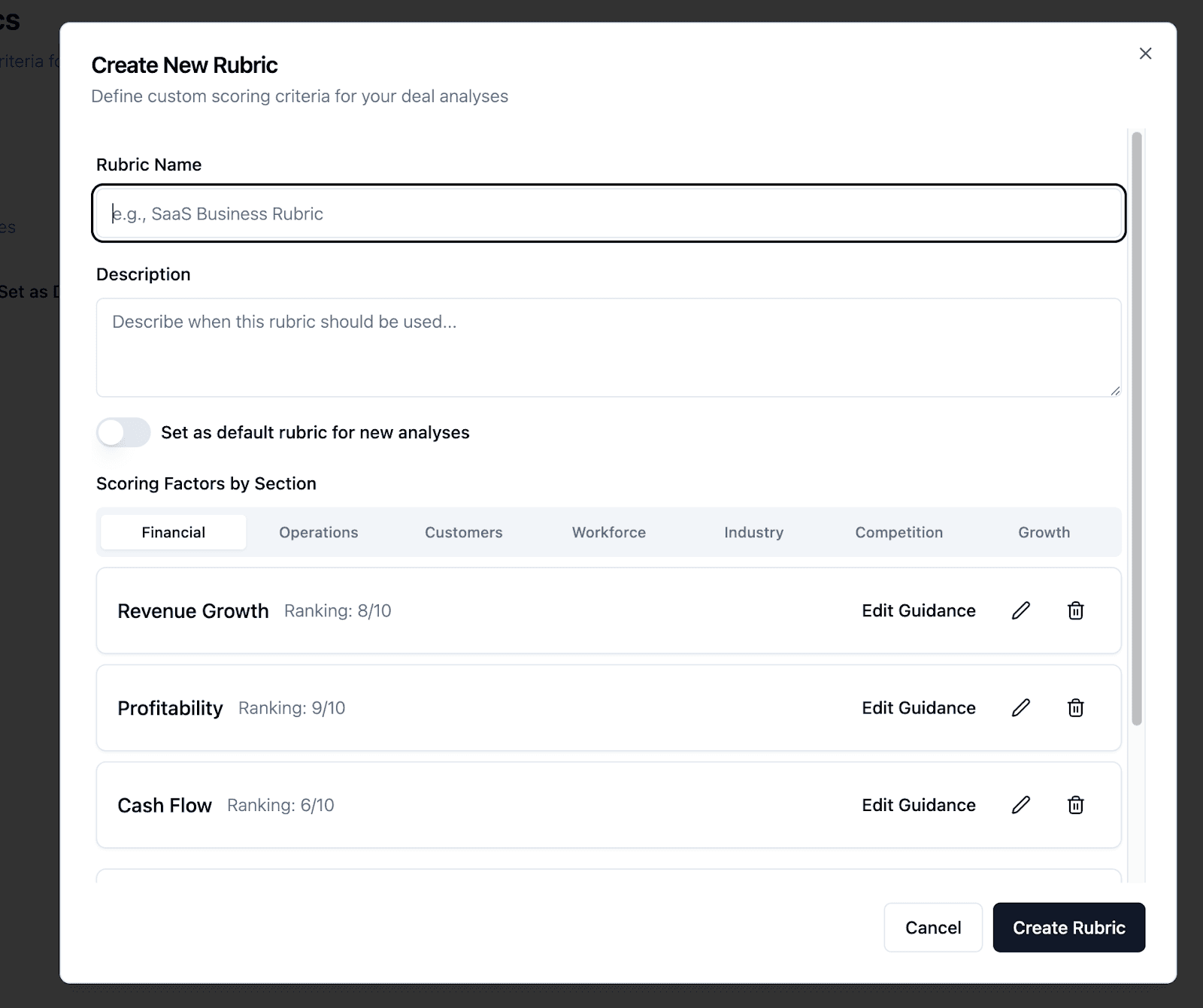

Here's what happens: You build rubrics that capture your investment criteria—revenue growth, EBITDA margins, market fragmentation, customer concentration, management quality, competitive moats, whatever matters to your fund. You can have multiple rubrics: a firm-wide one for general screening, plus sector-specific rubrics for beauty deals, industrial deals, software deals—so you're always comparing like-for-like.

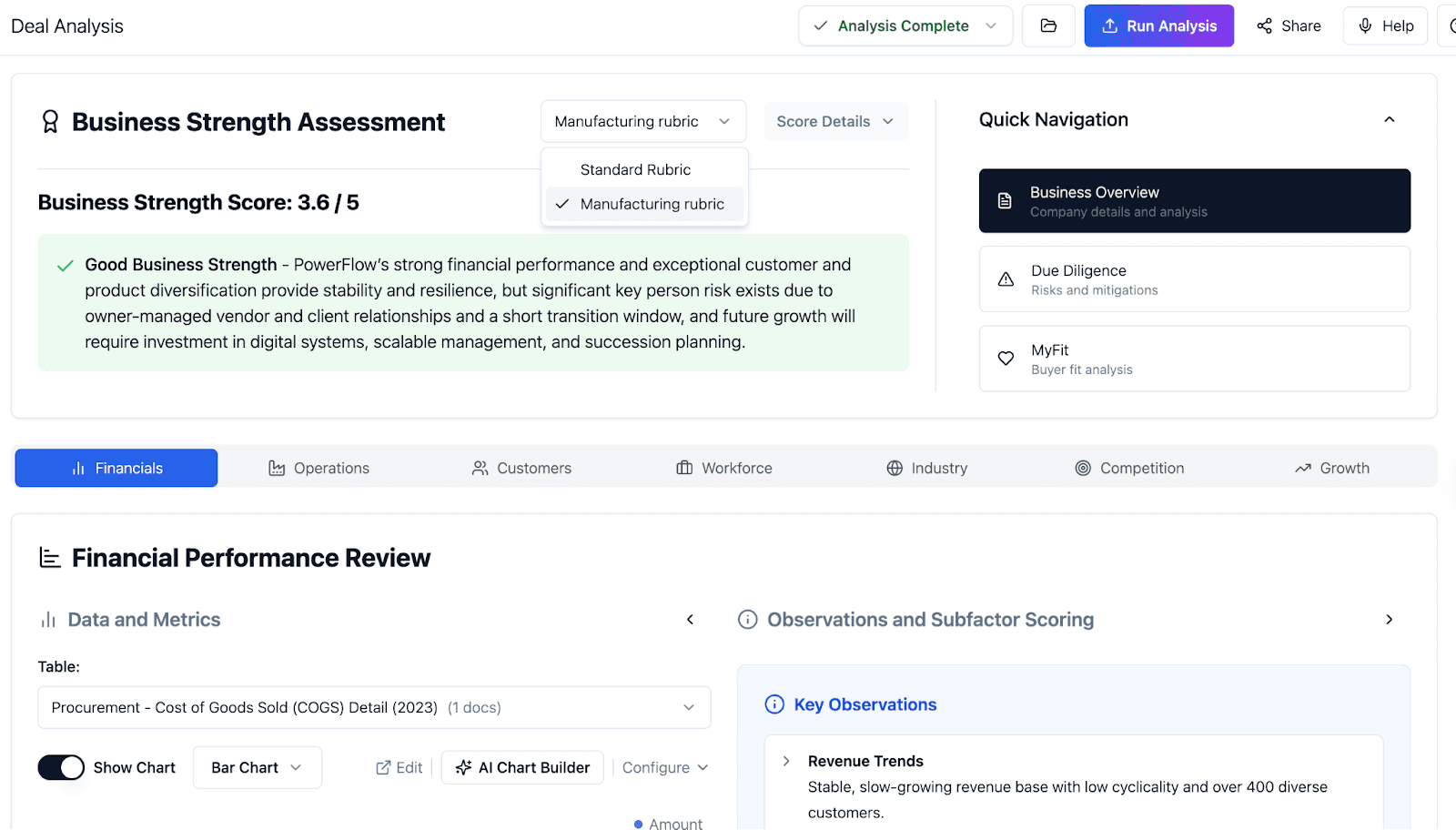

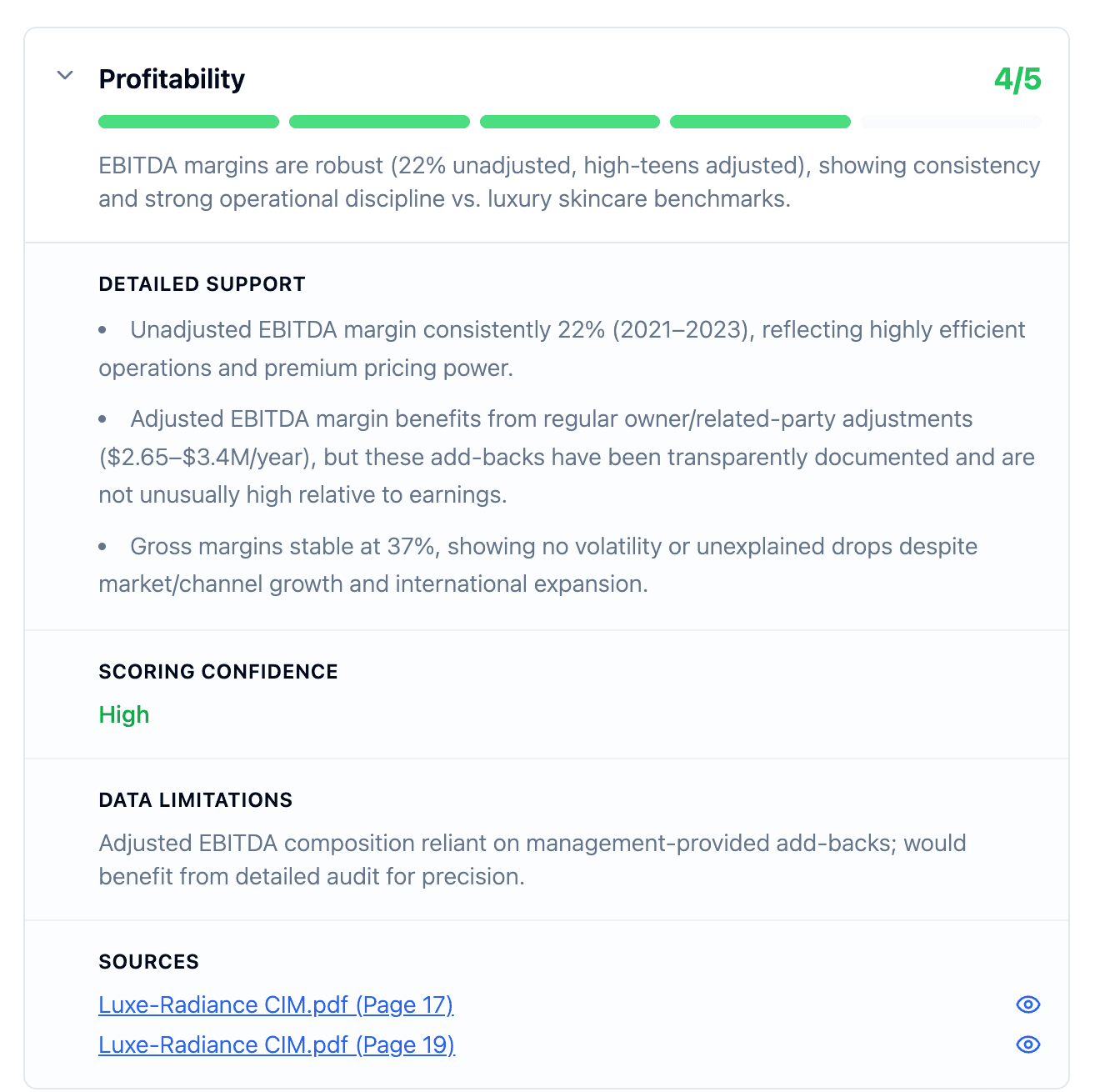

Each criterion gets scored on a 0-5 scale (with decimals like 4.1 or 3.8). You set weightings for each criterion based on importance—growth might be 30% of the score, margins 20%, management 15%, etc. The system calculates an aggregated weighted score (like 3.5 or 4.2 out of 5).

Upload a CIM, apply your rubric, and get an objective score with detailed analysis. The business analysis that comes out of the scoring goes into your deal context, so you can use the @ button to ask specific questions about the evaluation.

Unlike ChatGPT where you lose everything when you close the chat, DealSage stores every scored deal with structured, reviewable criteria you can reference later.

"Creating custom scoring rubric for PE deal evaluation in DealSage to systematically filter pipeline"

Four Ways Scoring Rubrics Create Investment Discipline

1. Define Your Investment Criteria Once

What actually matters to your fund? Build a rubric that captures your thesis. Growth vs. profitability. Market position. Customer dynamics. Capital requirements. Competitive positioning. Whatever drives success in your strategy gets weighted and scored.

"Custom scoring rubric creation interface in DealSage showing investment criteria and weighting"

2. Use Different Rubrics for Different Deal Types

Create a firm-wide rubric for initial screening across all opportunities. Then build sector-specific rubrics—one for beauty deals, one for industrial deals, one for software—that weight criteria relevant to each business model. This ensures you're always comparing like-for-like: beauty deals against beauty criteria, industrial against industrial criteria.

"Multiple custom rubrics in DealSage: firm-wide screening plus sector-specific for beauty and industrial deals"

3. Screen CIMs Fast Instead of Reading for 2 Hours

Run a 60-page CIM through your rubric and get specific criteria called out automatically. Customer concentration too high? Flagged on page 2 of your analysis, not page 47 after you've already invested 2 hours reading. Within the first 48 hours, you know whether a deal scores 4.0+ on strategic fit or below 2.5. High scorers get your full attention. Low scorers get passed with clear documentation.

"Deal pipeline view showing custom rubric scores for rapid filtering and prioritization"

4. Compare and Contrast with Consistency

"Show me all deals that scored 4.0+ on market attractiveness but below 3.0 on management quality." Your pipeline answers instantly. Compare deals side-by-side using the same weighted criteria (0-5 scale with aggregated scores like 3.5 or 4.2). See patterns in what works based on objective scores, and reference the business analysis in your deal context using @ button.

Why This Matters: Structure Beats One-Off Prompts

Many PE professionals are trying to solve this with ChatGPT—pasting CIMs and asking custom prompts. But they're getting inconsistent results. One analyst's prompt produces different scores than another's. Everything disappears when you close the chat. There's no way to review, compare, or reference the analysis later.

DealSage's structured rubric system solves this.

Your criteria are defined once, applied consistently across every deal, stored permanently, and reviewable anytime. The business analysis that comes from scoring goes into your deal context, so you can ask follow-up questions using @ button without starting from scratch.

One PE firm we worked with had "shiny object syndrome." Partners would get excited about deals that looked interesting but didn't actually fit their strategy. They'd spend weeks in preliminary diligence only to pass at LOI because the unit economics didn't work or customer concentration was too high.

After implementing custom scoring rubrics, they filtered their pipeline in the first 48 hours. Only deals scoring 3.5+ on their strategic fit rubric (out of 5.0) advanced to deep diligence.

The result: 60% more time spent on the right deals, 40% fewer blown LOIs.

That's the ROI of systematic evaluation—you stop wasting 2 hours reading CIMs that were never going to fit, and you make better decisions on the deals that matter.

Ad Hoc Evaluation vs. Systematic Rubrics: What's Different?

Feature | ChatGPT Prompts | Gut Feel Evaluation | DealSage Custom Rubrics |

Consistency | Varies by prompt/analyst | Different per person/deal | Same framework every deal |

Results storage | Lost when chat closes | Scattered notes | Permanently stored, reviewable |

Speed to decision | Fast but inconsistent | Weeks of discussion | 48 hours with consistent criteria |

Comparison ability | Can't compare across chats | Hard to spot trends | Filter and compare instantly |

Criteria weighting | Undefined | Varies by person | Explicit weightings (0-5 scale) |

Business context | Disposable | Fragmented | Stored in deal context for @ reference |

Step-by-Step: Getting Started with Scoring Rubrics

Define your investment criteria

What drives success in your deals? Revenue growth, margins, market position, management, capital efficiency—list what mattersBuild your rubric in DealSage or start with a template

Each criterion scored 0-5 (with decimals like 4.1 or 3.8), weight by importance to create aggregated scores like 3.5 or 4.2Apply rubric to new opportunities

Score deals as they come in, get objective assessment within first 48 hours—screen 60-page CIMs in minutesFilter and prioritize your pipeline

"Show all deals scoring 3.5+ on strategic fit" - focus time on high-scoring opportunitiesRefine rubric based on results

After 10-15 deals, see which criteria actually predict success, adjust weights accordingly.

Your investment discipline compounds as your rubric gets refined.

Pro Tips

Pro Tip #1:

DealSage has rubric templates you can use to get started quickly. We've built scoring frameworks based on common investment theses that you can customize to your specific criteria. Start with a template, adjust the weightings and criteria to match your fund's strategy, then refine based on results.

Pro Tip #2:

Create deal type-specific rubrics rather than one universal rubric. Your beauty deal rubric should weight brand strength and market positioning heavily. Your industrial rubric might emphasize operational efficiency and capital intensity. Different business models need different frameworks for like-for-like comparison.

Pro Tip #3:

All your prior scoring rubrics and deal scores are saved in DealSage. You can go back and view historical scores, compare how deals performed against their initial rubric scores, and refine your criteria based on what actually predicts success. The business analysis from each scoring goes into deal context for @ reference.

What This Means for Your Investment Process

Scoring rubrics create investment discipline at scale. Your criteria are defined, documented, and consistently applied. When you pass on a deal, you have clear documentation: "Scored 2.5/5.0 on strategic fit—margins too thin, customer concentration too high."

When a similar opportunity comes back 6 months later, you're not starting from scratch. You can see how the previous deal scored, understand why you passed, and quickly assess whether this one is materially different. The business analysis is stored in deal context, ready to reference with @ button.

After scoring 30-50 deals with your rubric, you start seeing patterns. Deals with management scores above 4.0 consistently outperform. Market fragmentation scores below 2.5 predict integration challenges. Customer concentration above certain thresholds correlates with underperformance.

These insights come from your own structured data, scored consistently—not from gut feel, fragmented opinions, or ChatGPT prompts that disappear when you close the tab.

Frequently Asked Questions

Q: How detailed should my scoring criteria be?

A: You can go really deep or keep it fairly high-level—DealSage supports both approaches. Most firms start with 5-7 high-level criteria (each scored 0-5) that truly matter to their strategy: revenue growth, profitability, market position, management quality, and 2-3 sector-specific factors. You set weightings for each criterion based on importance, and the system calculates aggregated scores (like 3.5 or 4.2 out of 5). The business analysis that comes from scoring goes into your deal context, so you can reference it later with @ button.

Q: Can I update my rubric after I've already scored deals?

A: Yes. When you update rubric criteria or weights, you can re-score your entire pipeline to see how deals rank under the new framework. This is useful when your investment thesis evolves or when you realize certain criteria matter more than you initially thought. Historical scores are preserved so you can compare before/after, and all the business analysis remains in deal context.

Q: What if a deal scores low on the rubric but I still think it's interesting?

A: Rubrics are decision support tools, not decision-making tools. If a deal scores 2.8/5.0 but has unique characteristics your rubric doesn't capture, you can note that and pursue it anyway. The rubric's job is to ensure you're explicitly acknowledging the trade-offs rather than unconsciously overlooking red flags because you're excited about one aspect of the deal. The structured format helps you understand why it's scoring low before deciding to proceed.

Ready to Get Started?

Schedule a call with sales to see how custom scoring rubrics transform your deal evaluation process.

Questions about rubric design or implementation? Email harry@dealsage.io