Dynamic benchmarking across your deal library

DealSage turns every deal you review into permanent benchmark data.

Nov 17, 2025

The Problem: You're Making Million-Dollar Decisions with Incomplete Context

You're evaluating a healthcare staffing company with 35% revenue growth and 18% EBITDA margins. Is that good for the sector? Exceptional? A red flag?

You vaguely remember another staffing business from 8 months ago that had similar margins but worse retention metrics. Or was the retention actually better? What was their customer concentration? Revenue mix?

You can't remember. The data is buried in some Excel file on someone's laptop. The analyst who worked that deal left the firm. So you're making a multi-million dollar decision based on gut feel and incomplete memory.

This is the intelligence gap that costs PE firms deals—or worse, causes them to overpay.

DealSage solves it by turning every deal you review into permanent, queryable benchmark data that makes every future evaluation faster and more informed.

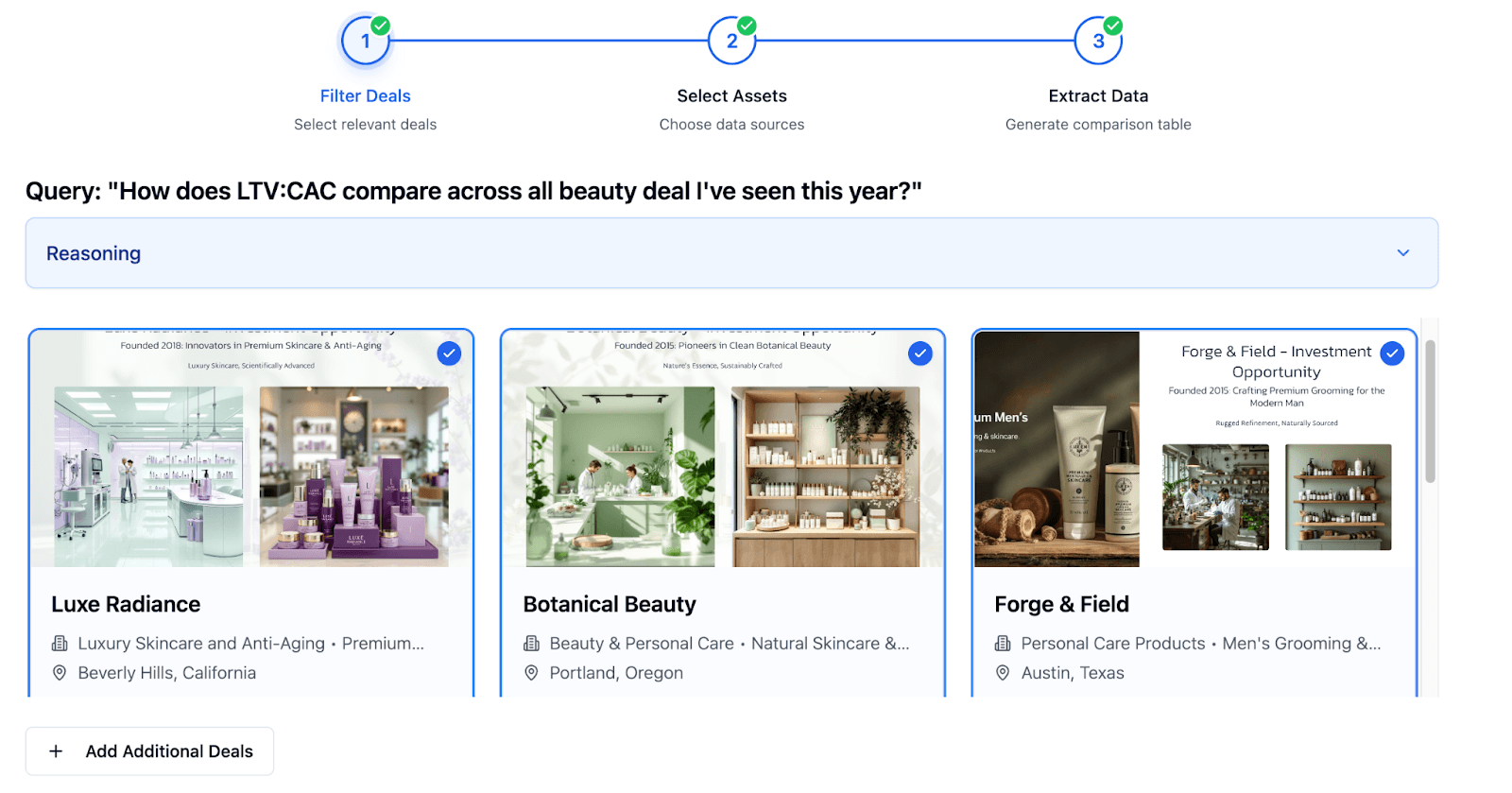

How Dynamic Benchmarking Works

Every deal you upload to DealSage becomes part of your proprietary intelligence database. Not just stored—structured, tagged, and queryable across every metric that matters.

Here's what happens: Upload a new CIM. You can compare it against your entire deal history—revenue range, EBITDA margins, growth rates, customer concentration, geographic mix, business model—every comparable dimension.

Within seconds, you see how this opportunity stacks up: "15 deals in your history match this profile. Median revenue growth: 28%. This deal's growth: 42%."

Use the @ button to pull in specific comparable deals, overlay their financials, spot patterns that separate winners from losers.

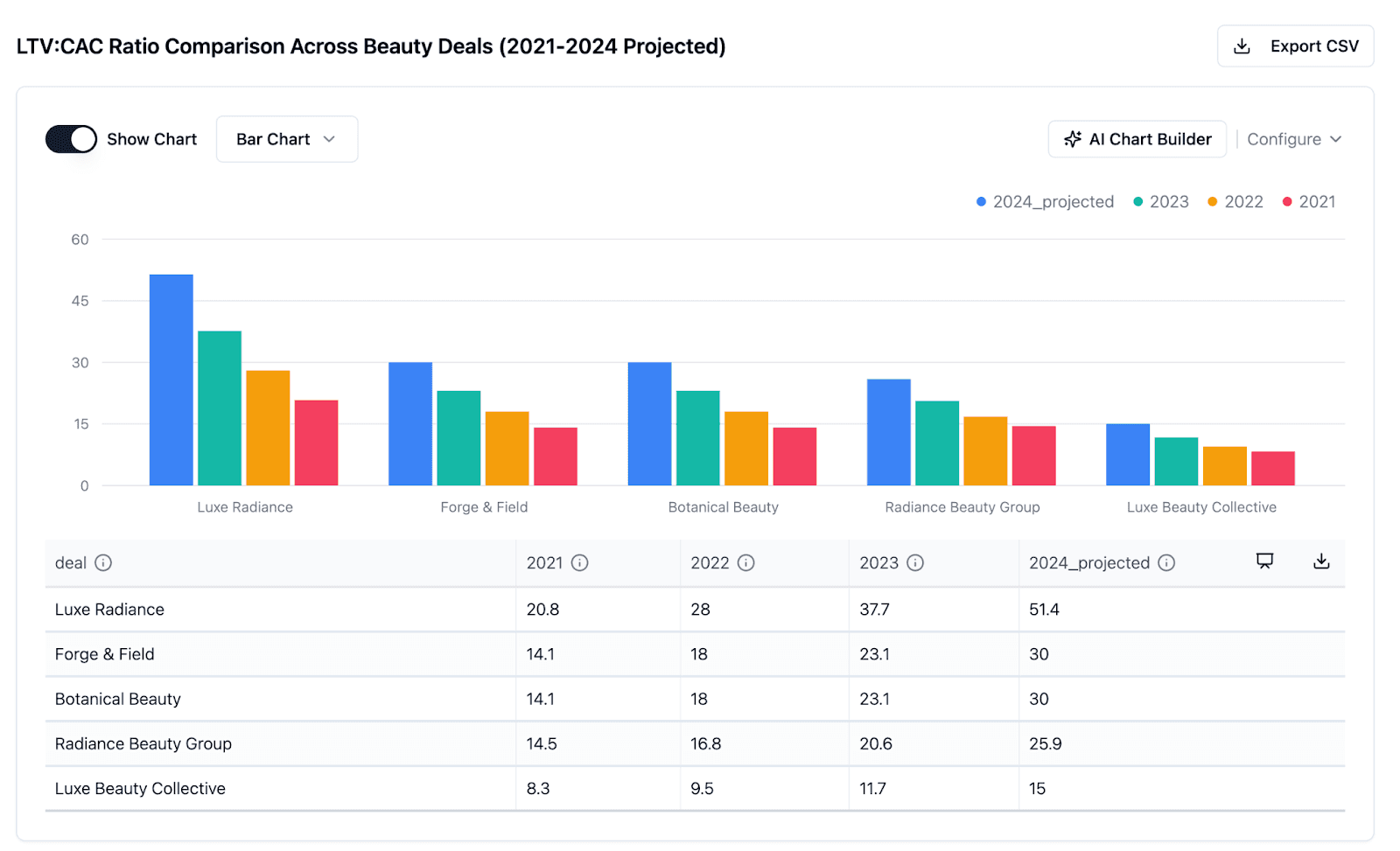

"DealSage benchmarking comparing deal KPIs and business metrics against private equity firm's historical deal database"

Four Ways Dynamic Benchmarking Creates Competitive Advantage

1. Compare Any Deal to Your Entire History Instantly

Upload a new opportunity and immediately see where it falls in your historical distribution. Top quartile margins? Unusual customer concentration? Revenue growth that's out of pattern? You know in the first hour instead of the first month.

"New deal comparison against historical deal database in DealSage benchmarking view"

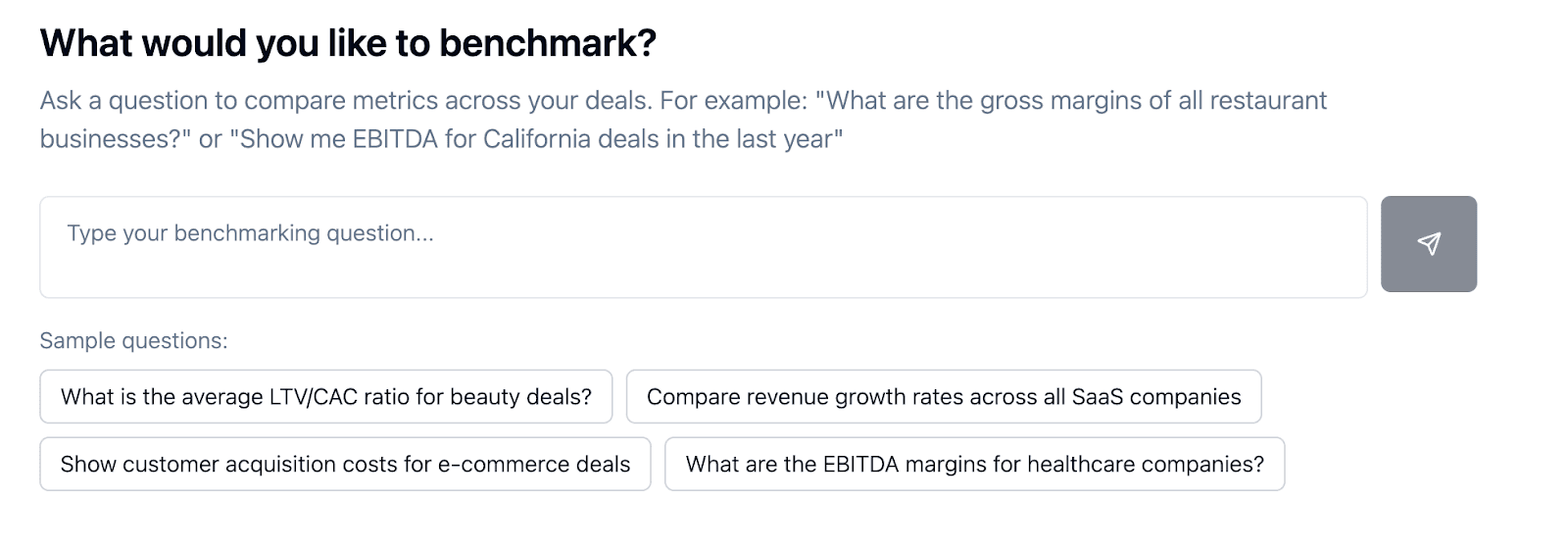

2. Query by Any Metric That Matters

"Show me all healthcare services deals with 20%+ EBITDA margins and less than $50M revenue." Your data answers in seconds. No spreadsheet archaeology. No asking around to see who remembers. Just instant, precise intelligence.

"Custom query interface in DealSage showing filtered benchmark results across deal metrics"

3. Spot Patterns and Outliers Before Your Competitors

Is this company's customer concentration unusually high for its sector? Are these margins too good to be true? Your historical data provides immediate context. The firms without this intelligence are flying blind—you're making informed decisions based on 100+ data points.

"Pattern recognition and outlier detection in DealSage private equity benchmarking analysis"

4. Build Investment Theses from Your Own Data

Which sub-sectors consistently outperform? Which deal structures create the most value? Which margin profiles predict success? Your proprietary data tells you—not some third-party report that everyone else also has. This is institutional knowledge that compounds with every deal.

Why This Matters: The Intelligence Moat

Imagine you're a lower-middle-market PE firm passing on deals because they "feel expensive" but you can't quantify why. After building your DealSage benchmark library with 80 past deals, you realize you've been systematically overpaying for deals with high revenue growth but low customer retention.

You adjust your underwriting model, start filtering deals more aggressively on retention metrics, and see first-year MOIC improve by 0.4x across your next 5 investments.

That's a multi-million dollar insight that comes from your own data—not from consultants or industry reports.

After 12 months with DealSage, you have a proprietary intelligence advantage that competitors can't replicate. They're still operating on gut feel and fragmented Excel files. You're making decisions backed by structured institutional knowledge.

Static Spreadsheets vs. Dynamic Benchmarking: What's Different?

Feature | Excel Comp Sets | DealSage Dynamic Benchmarking |

Data updates | Manually rebuild for each deal | Compare to all historical deals with one click |

Query flexibility | Limited to pre-built views | Query any metric combination instantly |

Data persistence | Scattered across files and laptops | Permanent, centralized, searchable database |

Pattern recognition | Manual analysis required | Automatic outlier detection and pattern spotting |

Cross-deal insights | Hours of manual consolidation | Instant visualization of trends and distributions |

Institutional memory | Lost when people leave | Compounds permanently with every deal |

Step-by-Step: Getting Started

Upload your historical deals

CIMs, profit and loss statements, past investment memos—whatever you have from previous evaluationsDealSage structures everything

Revenue, margins, growth, industry, geography, business model—all tagged and queryableUpload a new opportunity

Compare it against your entire history with one clickQuery and filter for comparable deals

Use @ button to pull specific comps, overlay financials, spot patternsBuild your proprietary intelligence advantage

Every deal processed makes your benchmark library more valuable and your decisions more informed.

Your competitive moat grows with every deal you review.

Pro Tips

Pro Tip #1:

The DealSage team will help with onboarding of your deal materials for enterprise customers. We'll work with you to upload and structure your historical deals to build your benchmark foundation quickly.

Pro Tip #2:

DealSage automatically tags deals with sector, sub-sector, business model, and other key attributes when you upload them. You can update these tags anytime to keep your library organized as your investment thesis evolves.

Pro Tip #3:

All your prior benchmarking analyses are saved and can be viewed anytime, so you're not duplicating work. The benchmark charts you create can be saved directly to your Deal Repository, making them reusable across future analyses without rebuilding from scratch.

What This Means for Your Investment Process

The best PE firms don't just have deal flow—they have proprietary intelligence about their markets. They know things their competitors don't because they've systematically captured and structured their institutional knowledge.

DealSage makes this accessible to every firm, regardless of size. Your 50-deal-per-year search fund can build the same intelligence infrastructure as a $1B AUM fund. The only requirement is that you capture the data.

Within 12 months, you'll have:

A proprietary benchmark database with 50-100 deals

Instant comparable analysis for every new opportunity

Pattern recognition that identifies winners and losers faster

Investment theses built on your actual data, not third-party reports

This is the intelligence layer that creates sustainable competitive advantage.

Frequently Asked Questions

Q: How many deals do I need before benchmarking becomes useful?

A: There's no minimum—even the last 3 deals you've evaluated can be beneficial. You'll immediately start seeing patterns in how businesses in your focus area perform. The more deals you add, the more powerful your comparisons become, but you don't need 50 or 100 deals to start getting value. Every deal you add makes your benchmark library more useful.

Q: What if I change my investment thesis or focus on new sectors?

A: Your benchmark library adapts. You can filter by any criteria, so if you shift from software to healthcare, you can isolate just your healthcare deals for comparison. Historical data from other sectors stays in your library—it doesn't get in the way, and it's there if you need cross-sector insights.

Q: Can I benchmark against industry data, not just my own deals?

A: DealSage is designed for your proprietary data because that's what creates competitive advantage. However, you can upload industry reports, public company financials, or third-party data sets, and they become part of your queryable library. The power is combining your private deal experience with any external data you find valuable.

Ready to Get Started?

Schedule a call with sales to see how DealSage builds your proprietary intelligence advantage.

Questions about data security or implementation? Email harry@dealsage.io